Former US President Bill Clinton’s legendary political consigliere James Carville famously quipped about the 1992 presidential election that all that really mattered to voters was “.. the economy stupid…” His prescient and succinct political framing resonated with voters who could see the economy slowing, and they rewarded Clinton by making incumbent Bush the Sr. a one-term president despite his successful navigation of the immediate aftermath of the breakup of the Soviet Union, and high public approval ratings for his handling of the First Gulf War.

I am not too keen on having a political discussion, but I do think the parallel is instructive when examining the current state of the economy and the real estate market. Sometimes we are just in one of those “Occam Razor's” moments where the simplest explanation largely suffices as a lens through which to interpret the data. I think In this case, in regards to real estate, the mantra should be “..It’s the interest rates, stupid…”.

No valued reader, I am certainly not calling anyone stupid. But I do think much of the discussion of other factors of the economy and real-estate markets miss the forest through the trees when really we should mostly be focused on the height and pace of interest rates rise,(and recent retreat), and the availability,(or lack), of credit.

Candidly, the reason I think many are not just laser-focused on interest rates is that they are 1.) shell-shocked by the rapid rise of rates, and 2.) many,(most), market participants have only operated in a declining, or low-interest rate environment where credit conditions were benign, and lending availability was ample. As legendary investors Jeremy Grantham and Howard Marks have both recently noted, most investors only really intellectually understand what it is like to invest in a high-interest rate environment–most have not experienced this “Sea Change” in their lifetimes. But Julian, you might say, didn’t credit conditions tighten quite rapidly in both the financial crisis,(08 and 09), and during the onset of the COVID-19 pandemic,(Q1 2020)? Great point valued reader! These two caveats also illustrate my point about the point of credit availability being crucial to the real estate market’s health. Both of these crises were solved by fiscal and legislative policy makers intervening in markets with a combination of A.) cutting key interest rates, and B.) providing fiscal stimulus, and/or support to the impacted market. (ie. Banks and money markets in the GFC, and a multitude of markets during the onset of the COVID pandemic). With rates lowered, credit conditions loosened, and coupled with fiscal stimulus, real-estate markets,(and most asset classes), boomed.

The important distinction this time around is that I don't think the combination of those two policy tools,(ie. reduction of interest rates or fiscal stimulus), are available to monetary or fiscal policymakers to the same degree in an environment with elevated inflation, and high levels of debt. (An economy has a lot less room to grow debt at levels from time past when it is already at a level of 120% of debt to GDP. Also, if you are already running high deficits when you are not in a recession, and having waning demand for treasuries when you sell them, what would interest rates have to be at to fund even larger deficits in a recession to entice foreign and domestic buyers of US debt? Foreign interest in UST’s has been waning to a decade low of 30% of all holdings despite the compelling real yields available to investors. Perhaps this is part of the reason why Ken Griffin sees higher structural inflation lasting for the next decade)?

What were tailwinds and favorable conditions in past cycles, are now headwinds. If you are trying to tame inflation by raising rates, and the job isn’t done, how do you lower them to save real estate, banks’ fixed income or loan portfolios, or asset markets? Yikes. I don’t envy the tough box policymakers find themselves in. Something has to give, and either inflation slaying, currency strength, or asset market health must be sacrificed. I am having trouble seeing how you accomplish all concurrently.

So what are we to make of the interest rate whipsaw volatility we have seen in the last 3 weeks? We have gone from concerns on term rate premiums, mortgage rates at 8%, and now approximately a 30 bps retracement in rates on the heels of another FED Rate hike pause, and continued signs of cooling inflation. The trajectory for disinflation seems to be indicating that core PCE could decline to 3% by the first half of 2024. The FED futures’ markets seem ready to declare that not only is the FED’s rate hiking cycle done, but that rate cuts are anticipated in 2024, despite Chairman Powell claiming that a reversal in monetary policy is “...not even being discussed…”. Stock markets have rallied in November as many investors appear to embrace the hopes that a “soft landing” narrative for the economy is within reach, and policy makers can thread the needle of vanquishing inflation while not slowing economic growth to the point of a recession.

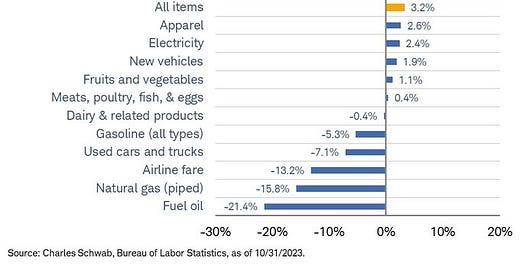

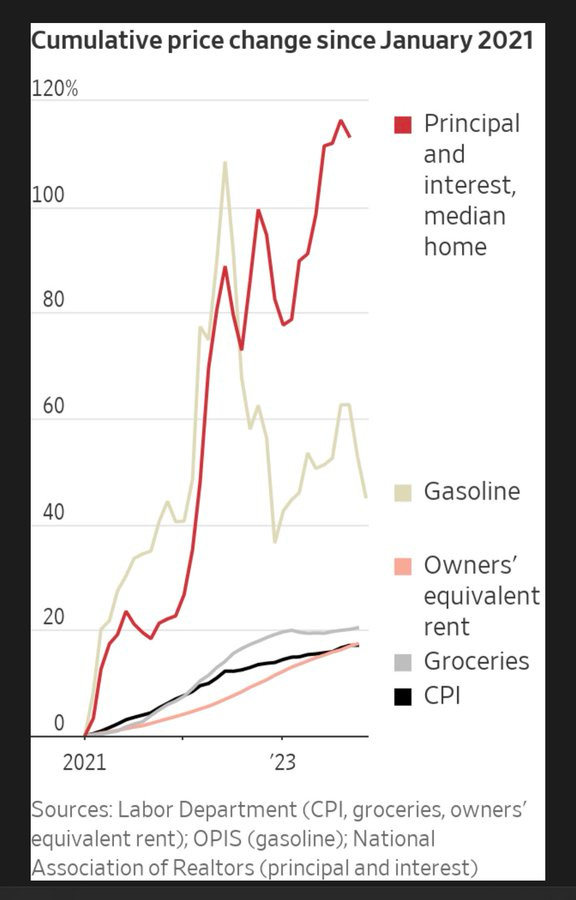

But if one unpacks the recent inflation print components, and examines the factors driving them, are the declines in inflation a sign of effective policy, or a slowing economy, demand destruction, and confirmation of a policy error?

With the FED’s 2% inflation target not yet met, policy makers could find themselves in a bind where inflation remains stubbornly persistent, as credit contracts, and economic activity stagnates. Oil prices just hit their lowest price in 4 months as inventory builds on signs of cooling demand, rising unemployment, and a decline in retail spending as noted by Walmart’s cautionary holiday sales’ forecast. While US manufacturing,(ISM), showing a reading of below 50 in October was likely impacted by the large-scale auto sector labor strikes, the decline in oil demand, and the lowest consumption in manufacturing lubricants in forty years is harder to attribute to temporary labor strife.

It also should not be forgotten that approximately ⅓ component of the CPI basket is made of “Owner’s Equivalent Rent”,(OER), which continued its multi-month decline as rents either flattened or declined across most markets for multi-family units in the US. This trend is likely to continue as a surge in future construction deliveries will contribute to growing inventory, rising vacancies, and further rent declines. While this will be welcome development for a renters’ cost of living,( and a FED Board looking to meet its inflation target), it presents a challenge to banks’ saddled with commercial real-estate loan portfolios concentrated with multi-family properties featuring declining fundamentals.

The most recent “Senior Loan Officer Survey”,(SLOO), report noted tighter lending conditions, and weakening demand for loans, which was supported by Q3 2023 bank earnings. More ominously, an astonishing 2/3rds of CMBS loans backed by office properties maturing in 2023 failed to be paid back or refinanced, metrics that are worse than the 08/09 financial crisis. It is hard to see how declining real-estate fundamentals coupled with a contracting credit environment is going to help banks in the near term. Granted they are rising off historically low levels, but commercial real-estate loan delinquencies at banks are at the highest levels in a decade, and it is not just driven by the office sector facing a secular demand shift, as failed Signature Bank’s recent FDIC loan auction also showed significant price deterioration in the multi-family sector which makes up a much larger portion of the real-estate loan market.

What is one to make of these various inflation components' knock on effects to the consumer and the economy? While households will surely find solace in relief they are receiving in declining rents, fuel savings, and even on food purchases at the grocery store, the cumulative impact of food, energy, and housing components of inflation since price increases picked up in 2021 seems to be contributing to a sentiment of economic malaise, particularly among lower income stratas.

So how does this elevated interest rate backdrop relate to where the real estate market is right now? Candidly, I think it is all that matters in the near to medium term.

Not a day goes by when I have clients, family members, or friends ask me some combination of 1.) “...Has the real estate market bottomed yet…?” or 2.) “..Is now a good time to buy a house…?” Leaving aside there are a lot of great non-economic reasons to buy a house,(ie. Household formation, access to good schools, family happiness, etc), and looking at this question solely through the lens of a price-sensitive, return-focused, investor, the answer in my humble opinion to A.) is the market has barely even started to go down yet, and B.) wait till you see how low prices will get if key borrowing interest rates stay near 8% for a prolonged period of time.

SOURCE: Warner Brothers Discovery

In short, I think we are in the “Wile E. Coyote”, stage of the market. The Coyote has run off the cliff, but hasn’t quite realized that he is about to plummet through the air.

(Caveat to my TX, AZ, or NV readers whose markets are actually already seeing substantial price corrections).

Why is there this disconnect and suspension of belief? Partly I think because of the conditioning of our favorite biases. It has been a long nearly 14-year party of low rates, and rising asset markets. People’s memories are short. The feedback loop of hindsight bias, recency bias, and confirmation biases are all powerful elixirs of self-delusion.

Also, in fairness, there are some confusing cross-currents at work in the markets. I think residential real-estate prices have stayed elevated and resilient because of a combination of the following reasons:

1.) Lack of Incremental Supply Caused By Existing Homeowner Rate Locks:

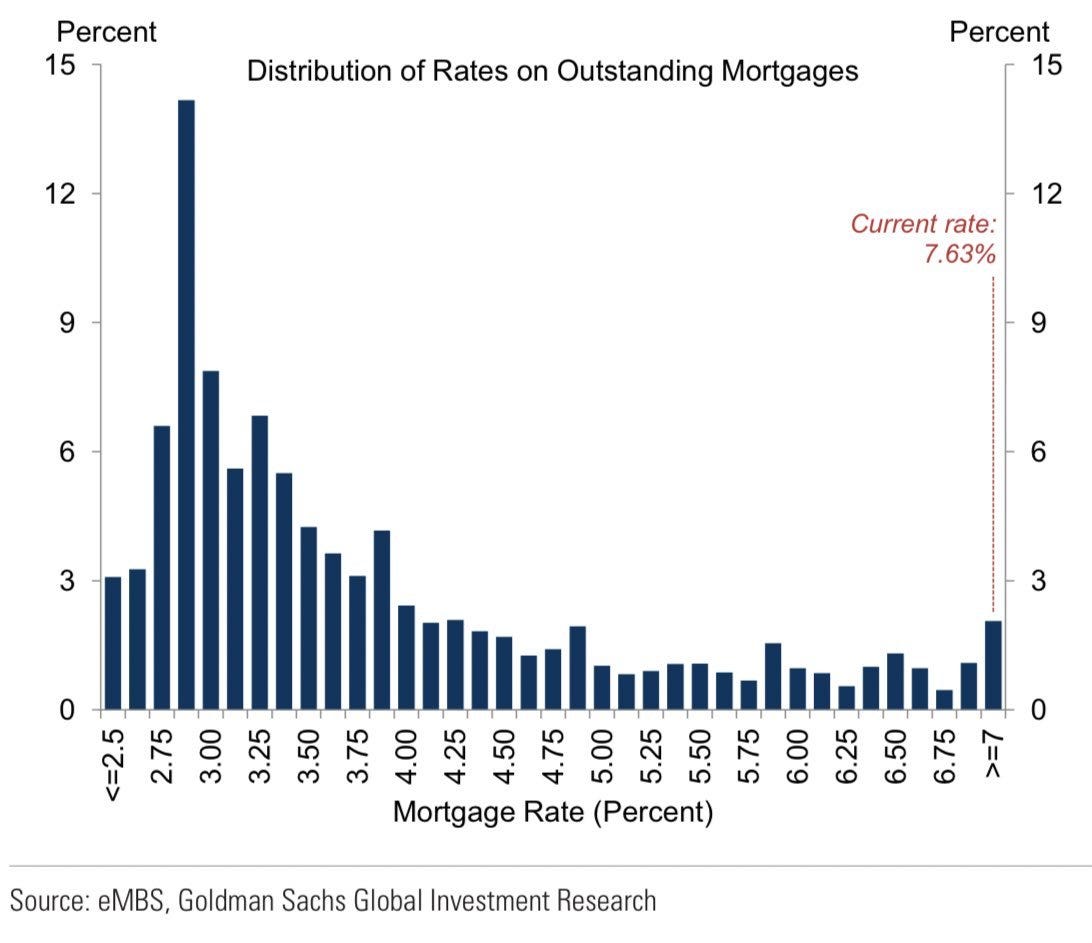

Thankfully many existing homeowners took advantage of historically low interest rates, and locked in 15 to 30-year mortgages prior to 2021. Amazingly nearly all homeowners are locked into mortgages with fixed interest rates below the prevailing rates of ~7.5%, and almost 30% have mortgage rates below 3% (Source: Chart Below by GS)

Many existing homeowners have no incentive to leave their current property for a new property with much higher monthly mortgage payments, and it is hard to see this disincentive dynamic changing for existing homeowners to increase their monthly payment even if rates declined to 5%. While this is likely great for society, (and wonderful to the existing homeowners who are benefiting from it), one shouldn’t underestimate how distortive this is to the supply side of the market for existing homes. New supply is going to have come from forced catalysts like job losses, or new home construction to offset this interest rate disincentive.

For home prices to decline you need to have a softening in demand, rise in inventory, and price cut % increases. We certainly saw demand collapse in 2023. Now inventory has begun to pick up late in the seasonal soft selling season of the winter, and the beginning of some price cut % increases. (Using the Denver, CO market as an example). You would need these latter two factors to continue, (and accelerate), into 2024 for prices to decline appreciably from here. What could cause that? The most likely answer seems to be a recession, increased job losses, and forced sales increasing supply.

2.) Bid/Ask Spread Gap:

In addition to home sales being sluggish there remains a gap between buyers' expectations of discounts, and sellers’ expectations of sales’ price. This disconnect is likely driven by sellers’ anchoring biases for a pre-2021 market, and the fewer well qualified opportunistic buyers in the market who are seeking to capitalize on a paradigm shift that now favors buyers who are not credit constrained. There are signs that this gap is resolving itself as sellers come to terms with their diminished pricing power position, and start to offer more price concessions. Still, given it is the morimound winter and holiday season, one would really need to see this seller price concession trend to broaden and deepen in Q1 2024 to accelerate price corrections on the downside.

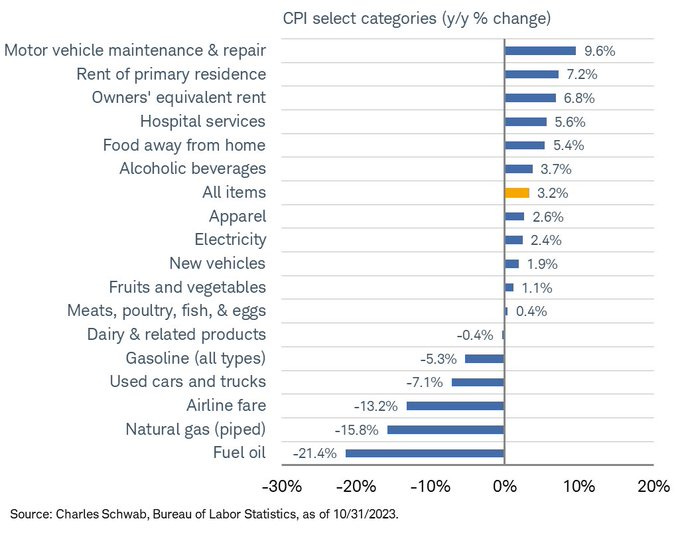

3.) The Bifurcation of the Existing Home vs. New Construction Market:

One of the more fascinating things I have found over the past year is the bifurcation of the new construction market, and until recently, the resilience of homebuilding stocks. Prolonged higher rates finally seem to be dampening this phenomena as homebuilder confidence had a big miss in October for its 4th straight month of declines, although new construction activity rose again for October,(particularly for multifamily), which seems to be a lag to the forward looking sentiment data. This is a leading sign of decreased starts and construction activity going forward. Still in many markets, homebuilders and new construction provide the only incremental supply inventory, and they offer many rate sensitive buyers competitive financing terms because of their ability and willingness to buy down mortgage rates. I expect this trend to continue where feasible as homebuilders will sacrifice margins in order to sustain their vertically integrated production business so they can recycle land and inventory.

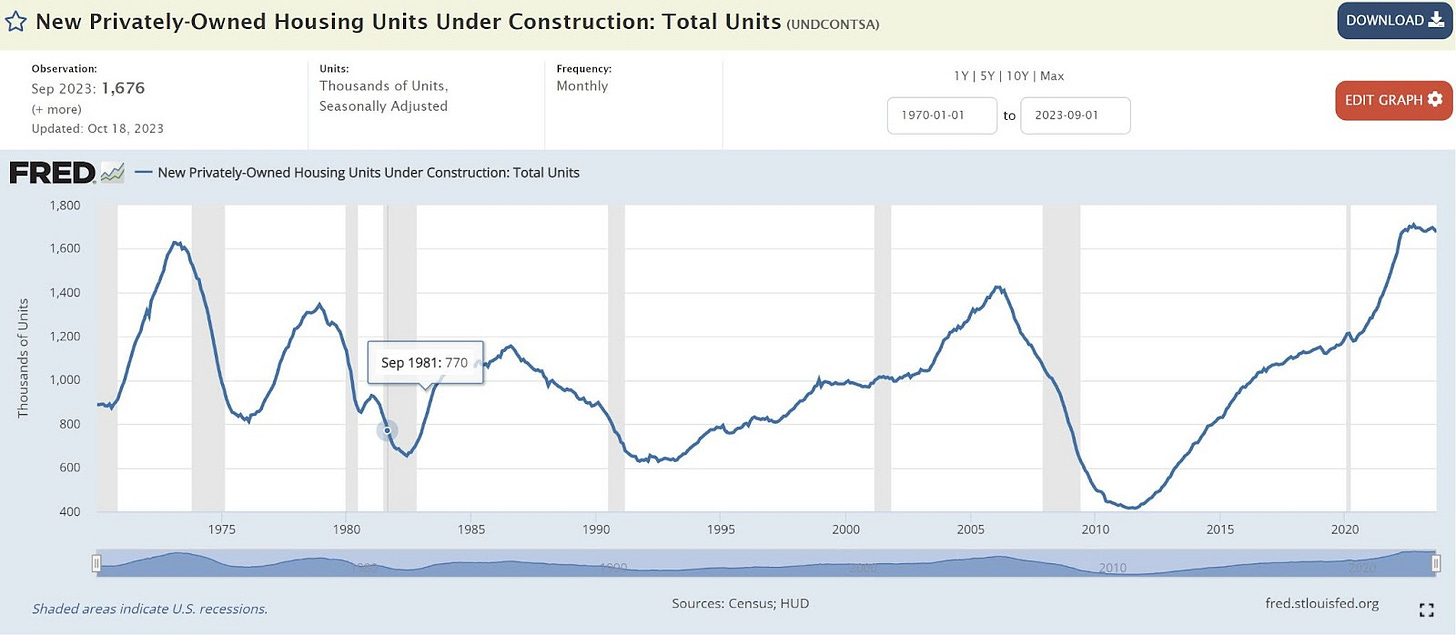

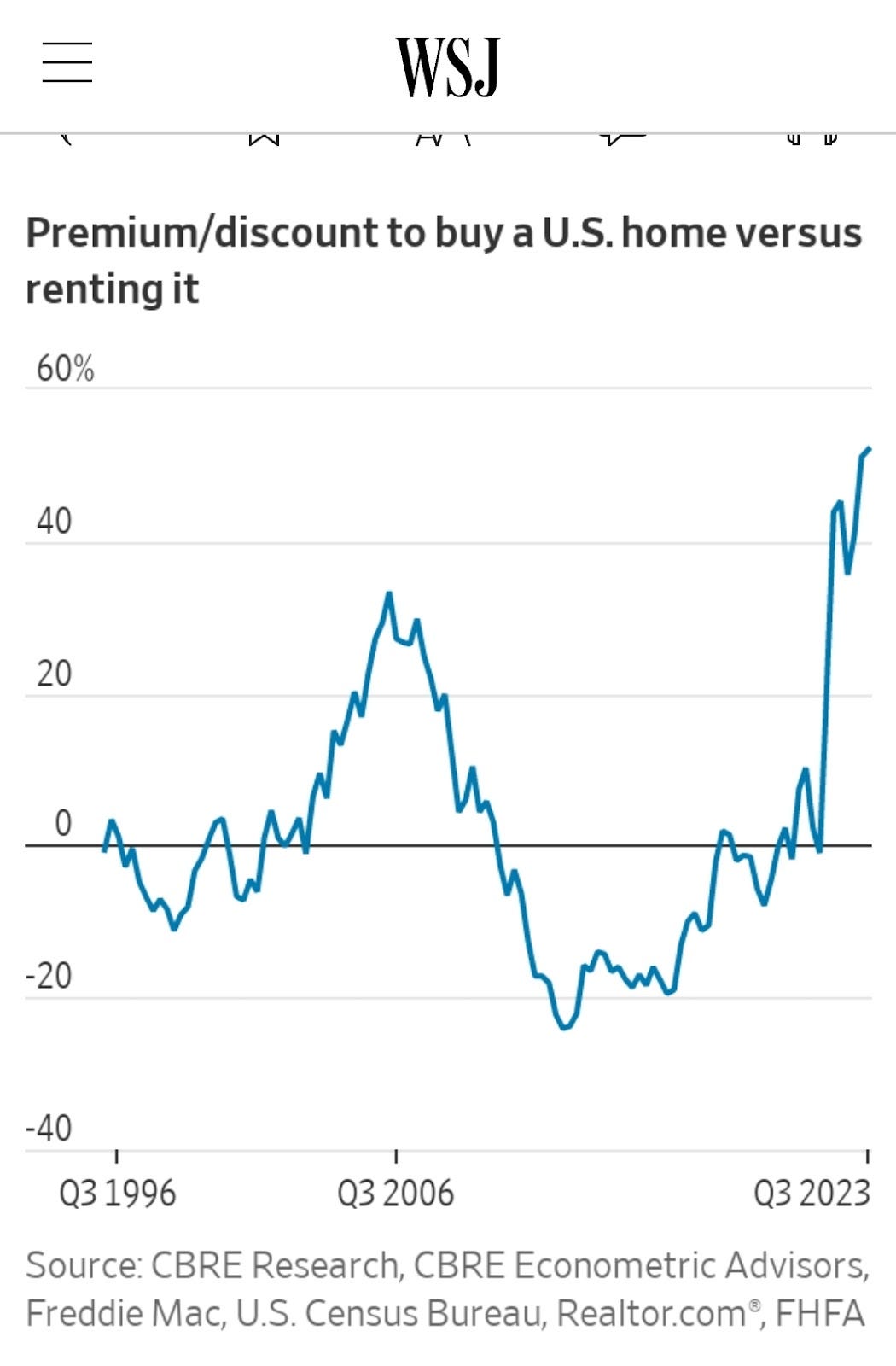

4.) It Has Never Been Cheaper to Rent Than Buy a Home:

As the WSJ noted in a simple chart,(below), it has never been cheaper to rent a home than buy one in most markets. This is largely driven by the unaffordability of elevated for sale prices coupled with high interest rates, but it is also being helped by the rental side of the equation with the surge in increased multi-family, BTR, and SFR supply. I see the spread likely persisting near term, but if it is to narrow, it likely resolves itself through lower priced for sale products caused by increased supply putting downward pressure on prices.

5.) Resilience of Employment Levels, and the Rebound of Equity Markets.

As we talked about in an earlier note, employment is still relatively stable, and the stock market is on pace for yearly gains in 2023 after declines in 2022. (The much larger Bond market is a different story as it may be on pace for its 3rd year of declines). With the large number of households with low fixed mortgage rates, and not much of a decline of dual income households due to job losses, distressed sales, or foreclosures, have been relatively subdued. (Source).

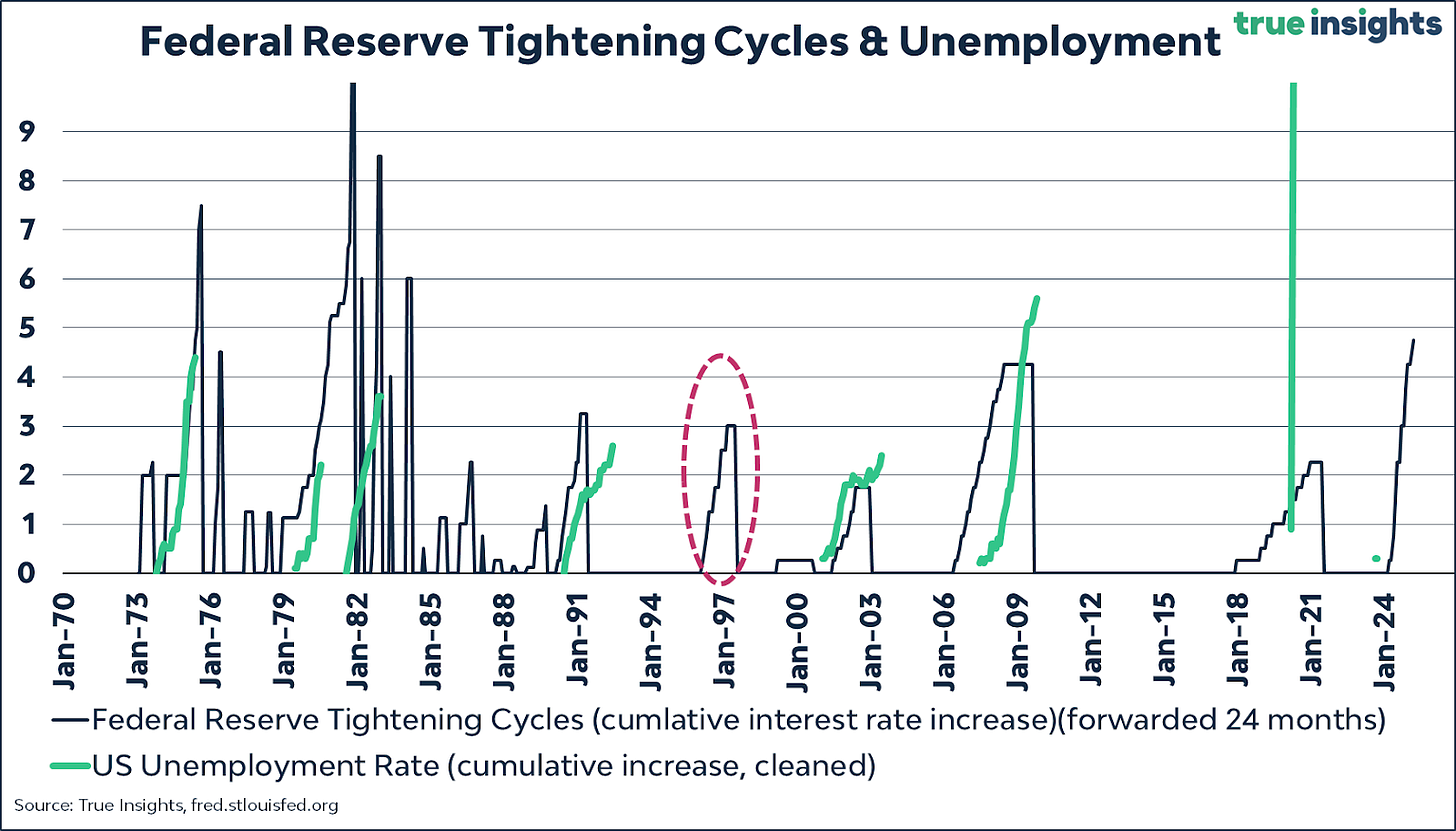

It is important to remember that historically job losses always lag a FED rate hiking cycle by about two years which brings us right into 2024.

Where are We Now and Where We May Be Going

So how does this market standstill resolve itself? Sales activity of existing homes has now fallen over 15% in 2023 as of September. With borrowing rates between 7.5% and 8% buyers have retreated from the market, and sellers have had to adjust selling expectations downwards. Frankly, when you factor in seasonality, the spring 2023 selling season was horrendous for most residential RE markets, particularly in the Sunbelt and Western United States. Lack of credit, and the bid ask spread disconnect between buyers and sellers, has brought the residential market to a stand still.

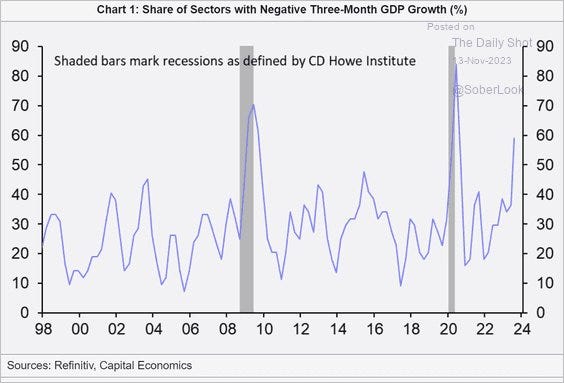

How does this stalemate resolve itself? I think a slowing economy/recession will lead to job losses, which leads to more supply, and a downward pressure on prices to resolve the lack of affordability from reduced borrowing power. As a breadth of GDP signals demonstrate that persistent inflation and higher rates are forecasting an impending recession.

Brief Musings:

PropTech Product Recommendation:

If there ends up being a prolonged higher rate environment, recession, or just a wave of loan defaults I think there will be a surge of real-estate investment activity the next few years. Investors will need tools to source, sort, and analyze prospective properties. Dealtracker.AI has been the best proptech software I have discovered to help with this process. It is comprehensive in its scope of data aggregation for customizable searches, and utilizes AI powered analytics to drive your underwriting criteria. The UX is also very intuitive and crisp, and it is much more cost effective than available alternatives. Check out a free trial HERE.

NAR Lawsuit Verdict: End of An Era?

In what could be a landmark verdict for real-estate industry in how brokerage commissions are paid, a Missouri jury found that the “National Association of Realtors'',(NAR), an industry trade group, guilty of antitrust practices that harmed consumers, and inflated brokerage commission amounts. The verdict calls for NAR and its co-defendants to pay a fine of $1.8 Billion, and other potential remedies.

In theory the case is a watershed moment as it potentially reduces the commission amount paid in a brokerage transaction, changes the incentives for independent contractors to join a trade group, and upends the practice of buyer-side commissions being paid by the sellers. In practice this case will likely face lengthy litigation and appeals all the way up to the supreme court, and won’t change customer or industry practices for many years.

However, it is worth keeping a close eye on. Many other commission based industries,(like securities’ brokerage), have seen a consistent compression of commissions over time as unfettered competition and technology disintermediation drove down transaction costs. In law, all brokerage commissions are negotiable between clients and their brokers, although prevailing norms vary by jurisdiction, residential real-estate commissions typically range from 4% to 6% of the gross sales’ price depending on how many brokers are involved, and their relationship with both the buyer and seller.

Changes doesn’t have to be bad for the industry, as commercial real-estate brokers typically negotiate a bespoke commission schedule structure with clients given the complexity and gross value of the deal. The residential Real-Estate brokerage community could easily adopt this practice. Furthermore, dire predictions about attrition to residential real estate brokerage ranks and lost commission revenue may prove to be hyperbolic, as many brokerage firms were already utilizing increased technology to meet customer demands and respond to cost pressure. An industry trade group, however, like NAR, may view this case as an existential threat to its business model of attracting dues paying members, and maintaining walled garden multiple listing services,(MLS), and will likely prove a fierce appellate.

WeWork Bankruptcy: “We Workout”

While there are certainly many contenders for the most outrageous speculative frenzies during the past decade’s “everything bubble”, including blenders to dispense juice, publicly traded scooter sharing companies, and people thinking digital pictures of cartoon monkeys were stores of value, the the poster child of excess and mal-investment might be coworking and office space sub-leasing company “WeWork.” The company finally filed for bankruptcy at the beginning of this month, after a roller coaster of a corporate life that included stints as the most valued private company ever, the ousting of its flamboyant co-founder, Adam Neumann, for multitudes of questionable behavior including accusations of self-dealing, a failure to go public once, eventually going public at a much lower valuation via a SPAC, at least two restructurings led by Venture Capital firm Softbank, all before eventually subcombing to its bankruptcy fate.

There have already been numerous books,(I recommend this one), movies, and podcasts,(including one in 2019 where I discussed and foreshadowed its problematic valuation and business model), which have dissected WeWork’s faux pas. My primary criticism all around was that first this was a real-estate company, not a tech company, and second, it is never a good idea to have a mis-match of asset durations,(short term tenants’ payments), with your liability durations,(long term lease obligations). This asset-liability mis-match can work in a rising market when you can master lease space cheaply, and sub-lease portions of it for more expensive rates, but it will be vicious in a declining market, let alone one where the office market faces a pandemic, and secular behavioral shifts around remote work, distributed teams, and commuting. Co-Working can be a fine business when done in a right sized manner. (Just look at publicly traded and profitable ‘Regus’).

The fallout of the WeWork collapse will be interesting to watch as they will be able to cancel many unprofitable leases in bankruptcy, and shrink their location footprint. Near term it will likely be disruptive for plenty of their tenants, with WeWork’s implosion also impacting some concentrated landlords and CMBS investors. Long term it could make some creditors and distress turnaround investors a lot of money if they can execute like a real-estate company and right size the location footprint, and restructure the failed co-working company’s balance sheet.

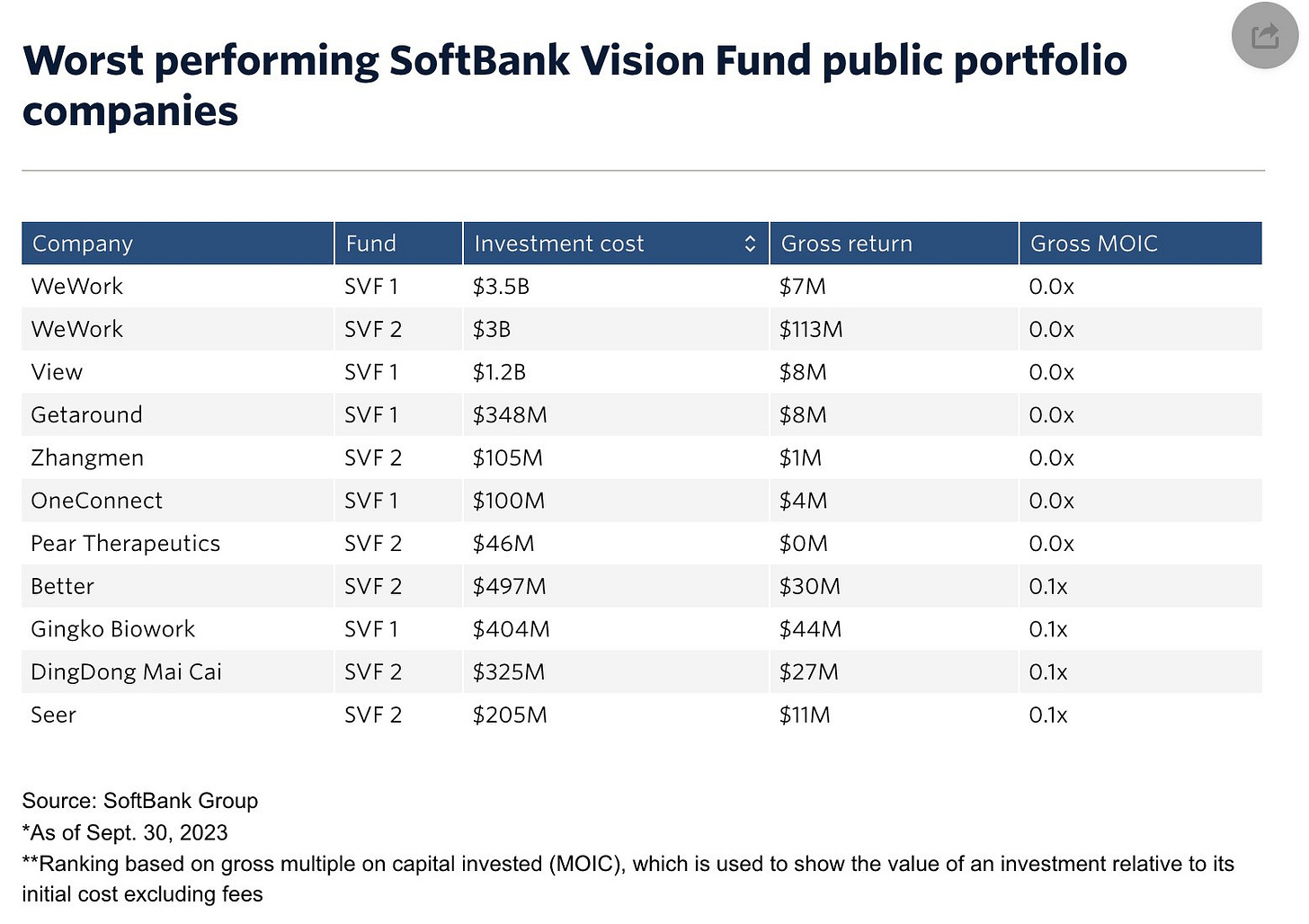

Finally, after losing over $14 billion for investors on WeWork, and billions more on other real-estate businesses masquerading as tech companies like brokerage firm Compass, home flipper OpenDoor, smart glass maker View, and construction contractor Katerra, one wonders what Softbank, its founder Masayoshi “Masa” Son, and the investors in their “Vision Funds” learned from this incineration of investor capital?

Attention: The information contained in this email, and any attachment, is confidential and is intended solely for the use of the intended recipient. Access, copying, distribution or re-use of this email or any attachment by any other person is not authorized. If you are not the intended recipient please advise the sender immediately and destroy all copies of this email, and any attachment. Nothing presented here should be deemed to constitute a recommendation or an offer to sell any investment product. This message does not constitute investment advice. Please do your own research. Past performance is not indicative of future results. We cannot guarantee that this email or any attachment is virus-free, and accept no liability for any damage sustained as a result of viruses. We may store emails sent to or from this address. Circular 230 Notice: Any written advice provided herein (and in any attachments) is not intended or written to be used, and cannot be used, to avoid any penalty under the Internal Revenue Code or to promote, market, or recommend to anyone, a transaction or matter addressed herein.

Colorado Real-Estate License,(FA.100103437), hung with Hatch Realty.