How Much Trouble Is The Real Estate Market In....?

......And What,(and Where), Are The Opportunities?

Introducing ‘Real-Estate Reconnaissance’, A Newsletter on Real-Estate Investing and Market Analysis:

Hello Readers!

Thank you for taking the time to read my first attempt at a public sharing of my views on the real estate market. For a few years now clients have been encouraging me to disseminate my opinions and analysis on the real estate market to a wider audience. Frankly, I demurred because I didn’t think the market was that interesting to opine on; everyone and their cousin was investing in real estate in a low-interest rate environment, awash with liquidity, supported by trillions of dollars of fiscal stimulus, all while being driven by a seamless boundless appetite for risk. Who wanted to read an analysis that was going to question how long that party could continue, and ask what the consequences of unbridled,(imprudent?) risk-taking may be? That would be no fun!

Now, however, I think the real estate investment environment is about to get really interesting. (Cranking interest rates up to a point where prevailing borrowing costs for real estate financing topped 8% this week will do that). Policymakers were slow to recognize that far from being transitory, inflation has become stubbornly persistent, and expectations of it remaining high have become elevated, entrenched, and anchored. (Source). Central Bank policy tools are blunt instruments, and raising the Fed Funds Rate from the zero bound to nearly 5.5% since March of 2022 is bound to have some unintended consequences for a US economy sitting on $26 trillion to $33 trillion in debt, (depending how you measure it).

And it is not just the degree of rate increases that have surprised the markets–it is the pace,(11 consecutive times with 1 brief pause), that has caught many market participants offside. We have now had 4 bank failures in the last year. While critics might say that none of this year’s bank failures were systemically important institutions, all were regional lenders, which like the entire regional banking sector, are responsible for nearly 80% of all commercial real estate loans. With $1.4 Trillion of commercial real-estate-related debt coming due in the next two years,(most of it priced at rates much lower than the current market interest rate which is the highest in 23 years), both CRE investors and banks face a “wall of maturities”, and loan losses. (Source) Credit conditions are tightening, and real estate is a very credit-intensive,(and interest-rate-sensitive) asset class.

Can policymakers slay the inflation dragon, without choking off economic growth, and hurting employment? So far the US economy has remained remarkably resilient. The most recent monthly jobs report showed a surprise gain of 336,000 new jobs, keeping the headline unemployment rate at 3.8%. Not bad. Similarly, consumer spending has remained strong with Q3 2023 coming in at a 3.7% rate year on year. Retailers also forecast additional growth,(albeit slower than last year), for the all-important Q4 holiday season, where 27% of annual sales for most categories are derived. (Source).

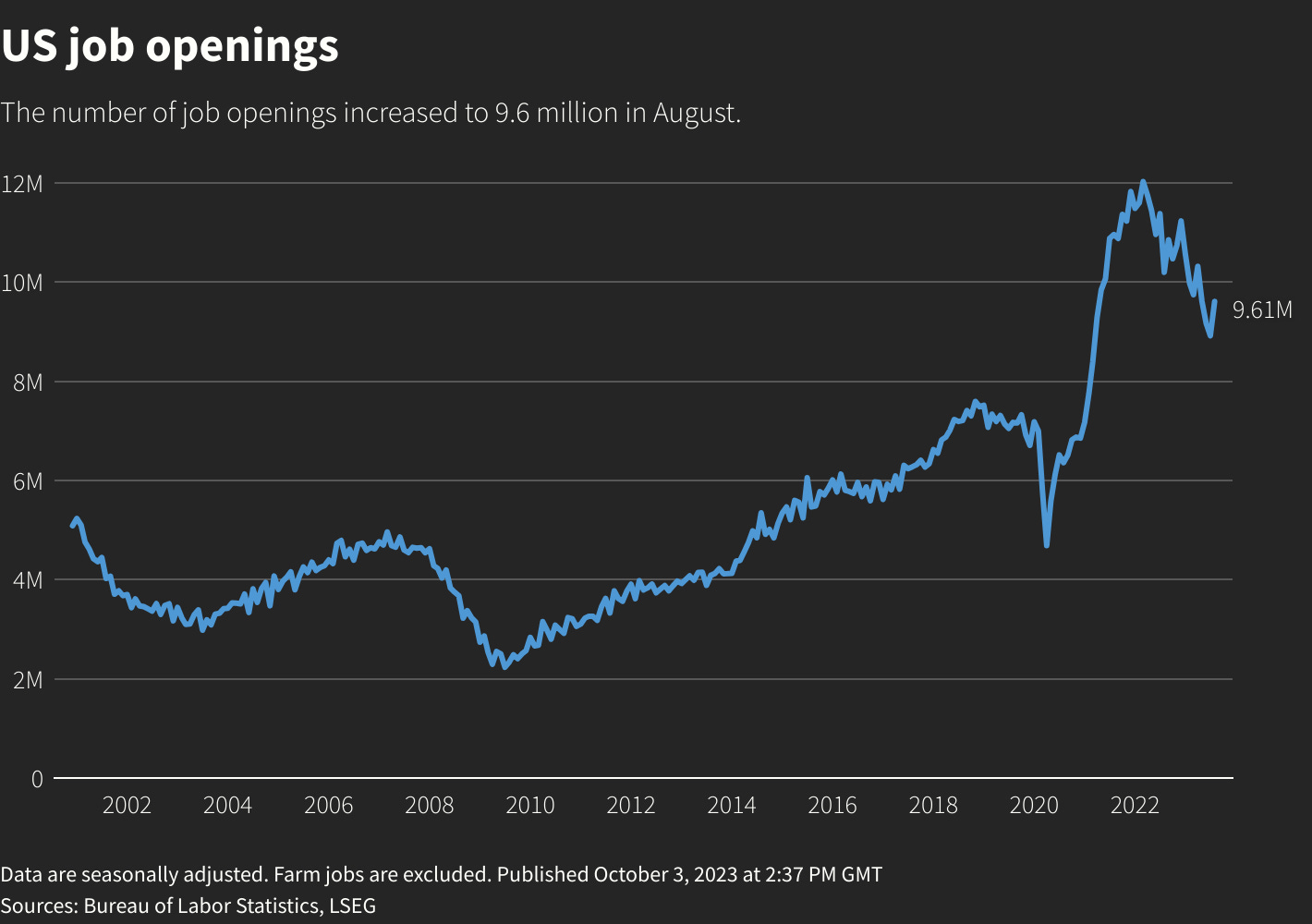

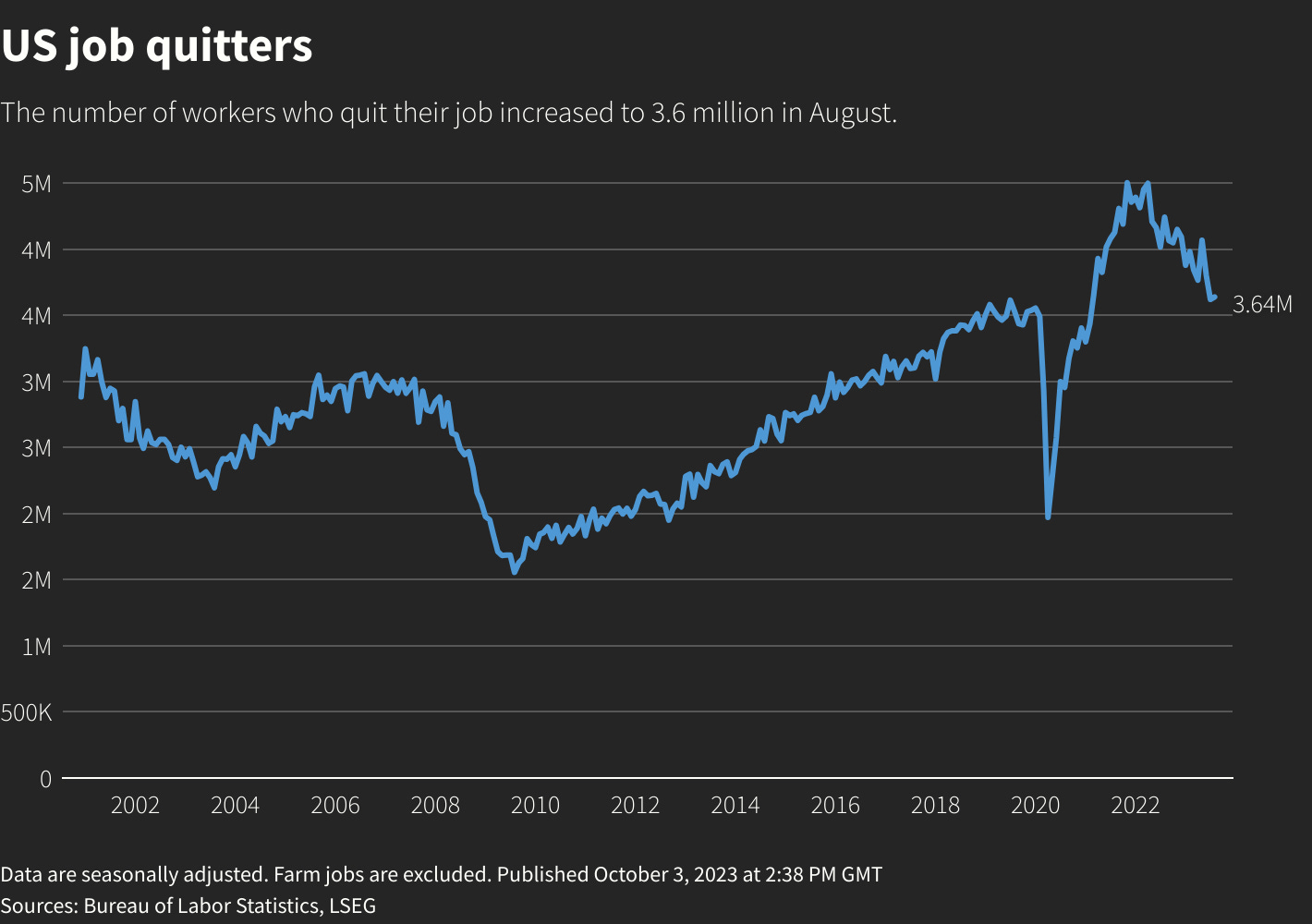

But is all as sanguine with the economy below the surface? A closer look at the jobs data would show that over 5% of workers are working multiple jobs,(a sign that many are struggling to find full-time work, or afford the higher costs of inflation), and while still at low levels the “quit rate”,(ie. workers leaving current jobs for new opportunities), is flat suggesting that the labor market may be cooling as the arbitrage opportunity of higher wages employees can find by going to a new job diminishes.

And what about the indefatigable and profligate American consumer? Additional scrutiny of spending data suggests purchasing power may be waning. Savings rates have gone from a COVID stimulus high to household reserves depleting nearly all of their $2.1 Trillion in excess savings. (Source). Credit card delinquencies and auto loan delinquencies are also on the rise to a level not seen in 10 years, as these types of consumer loans are typically structured with floating interest rates that have ratcheted higher as the Federal Reserve has raised its benchmark borrowing rate, and consumers’ wages have failed to keep pace with the increased cost of debt service.

How does this deteriorating economic and employment backdrop portend for real-estate markets? At the end of the day, broadly speaking the performance of real estate as an asset class is driven by a combination of the following macro forces:

Economic & Employment Growth

Population & Migration Growth

Credit Conditions

In my opinion, two of these conditions,(employment growth, and credit availability), are flashing bright red warning signs.

And what is the culprit for tamping down employment and credit growth? High-interest rates– the blunt cure for persistent inflation.

It is hard for me to see how you have a growing economy, with softening employment, the highest interest rates in twenty years, elevated inflation, and contracting credit conditions.

Contracting credit is certainly not a recipe for a booming real estate market.

Higher interest costs on debt are already causing a surge in business bankruptcies, credit card charge-offs, and auto loan delinquencies,(albeit all from low levels), which have all been a harbinger of distress in the real estate market in prior cycles

Can the real estate market,(and the economy), withstand a sustained higher rate environment for a prolonged period without suffering some combination of price declines, and defaults?

Early indications show that an elevated and rapidly rising interest rate environment is starting to cause distress to businesses, consumers, banking institutions, and both the commercial and residential real-estate sectors:

Sales of commercial properties are now down over 50% for the year, leading to price declines of over 10%, the biggest drop in 10 years. (Declines are much worse in sub-sectors like offices that are facing structural headwinds, and changing secular behaviors of tenants; these are issues that I will address in depth in a future post, along with how the adjustable rate nature of commercial debt markets and banking system fragility will lead to more catalysts for distressed commercial property sales).

For residential real estate, sales of existing homes are now on pace for the slowest annualized rate since the housing crisis a decade ago. (Source). Housing affordability–which is caught between a vice of high-interest rates, elevated prices, and a current dearth of inventory–is at its lowest level in nearly 40 years. This affordability crisis has caused mortgage applications to plummet to a near thirty-year low.

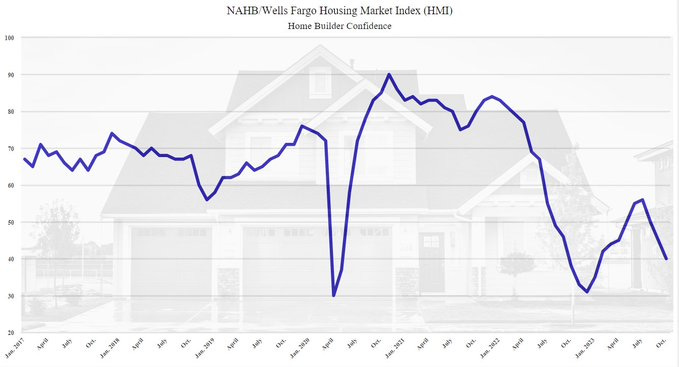

Until recently, the new home sales market had seemed to decouple from the existing home sales market, as homebuilders were able to offer the dwindling number of buyers incremental inventory in a supply-constrained environment, and incentives for purchases with mortgage rate buy downs. This bifurcation of the market seemed to be an unintended consequence of the majority of existing homeowners being locked into sub 4% interest rate mortgages,(itself a product of a decade of low-interest rate policy from regulators), disincentivizing them to move when faced with a higher rate for a new property purchase. Until the recent surge of mortgage rates to 8% homebuilders had the profit margin capacity to offer prospective buyers lower rate buy-downs with mortgage lending partners while still maintaining pricing power given the dearth of inventory. But affordability seems to have finally quelled this homebuilder market decoupling as both homebuilder confidence surveys,(below), and the stock prices of publicly traded homebuilders have each dropped precipitously in the last two months.

How much more in price concessions and rate buy-downs can home builders give selective buyers before they completely erode their profit margins?

Yes, housing is entering the seasonally soft period of the winter, but prices have only remained elevated in my opinion because of limited supply from existing homeowners locked into lower mortgage rates. Home Inventory has now crept up during a seasonally slow time; is that a harbinger of a continued increase in supply, and ultimately a softening of prices?

In past residential real-estate downturns, the following pattern has always followed a combination of something like the following: a decline in buyers leads to extended sales periods on the market, leads to price concessions, leads to more inventory, leads to more price concessions until the market reaches a clearing price equilibrium. With mortgage rates at 8%,(and heading higher IMO), I anticipate increased supply and price concessions to intersect, perhaps at a faster pace than one would anticipate. If we saw more signs of an imminent recession, stock market weakness, and a spike in job losses I think the correction could be faster and deeper than many would expect.

We shall see….

Goals for this newsletter:

Frequency: I plan on writing this newsletter bi-monthly. I hope that readers find it informative, and thought-provoking, and for it to lead to engaging conversations with my audience.

New Business: Perhaps this venture will also lead to new business opportunities whether it be advising, consulting, brokerage, or joint venture investments, I am always ready to engage with good people to discuss real-estate matters. Cycle-turning inflection points present both challenges and opportunities, and I am excited and prepared to be very active on multiple fronts in the next few years. During my career, I have worked on all property types, in multiple major markets across North America and the Caribbean, ranging from investment acquisition, repositioning and redevelopment, asset management, brokerage, and capital raising. Please reach out if there is anything you need help with, and would like to discuss.

Conversations: I certainly have neither a monopoly on good ideas nor a crystal ball on what the future holds. But I do have an insatiable curiosity for markets and real estate. I want to hear from my readers. I welcome all constructive criticism, debate, and questions. With readers’ permission, I will likely do deep dives and answer these questions in future posts. I think one becomes a better investor and operator by questioning their assumptions, stress testing their thesis, and both listening to and investigating all sides of an argument. I have made plenty of mistakes, but I have always learned important lessons from understanding where I misjudged the markets, and by identifying gaps I have missed in my analysis. Investing is humbling, and I think it is always important to admit what you don’t know and to keep an open and persuasive mind to alternate points of view. I hope to both learn from my readers and that my readers will hold me accountable for my views and analysis.

Suggestions: Please suggest topics that you would like to read more about! I am curious to know what you are seeing in your markets, and what is preoccupying your headspace. To get the ball rolling, I have made a poll with future topic suggestions. Please share your thoughts, and participate below.

Subscribe and Share: thank you again for reading this far! If you are enjoying the content, I ask that you subscribe to my posts and share with others that you think may enjoy, or benefit from the content.

DISCLAIMER: The information contained in this email, and any attachments, is confidential and is intended solely for the use of the intended recipient. Access, copying, distribution, or re-use of this email or any attachment by any other person is not authorized. If you are not the intended recipient please advise the sender immediately and destroy all copies of this email and any attachments. Nothing presented here should be deemed to constitute a recommendation or an offer to sell any investment product. This message does not constitute investment advice. Please do your own research. Past performance is not indicative of future results. We cannot guarantee that this email or any attachment is virus-free, and accept no liability for any damage sustained as a result of viruses. We may store emails sent to or from this address. Circular 230 Notice: Any written advice provided herein (and in any attachments) is not intended or written to be used, and cannot be used, to avoid any penalty under the Internal Revenue Code or to promote, market, or recommend to anyone, a transaction or matter addressed herein.